「テクニカルとかどうでもいいです!」

「相場観とかどうでもいいです!」

「小難しいことはしたくないです!」

「馬鹿でもわかる単純なこと教えてください!」

「それでも簡単に勝てる手法だけ知りたいです!」

…マジでふざけんな。こっちが今までどれだけ検証しまくって、睡眠時間削ってチャートにかじりついて、それでも負けて損切しまくってきたと思ってるんだよ。

FXで勝つのに簡単なんてあるわけないだろ。夢見すぎだろさすがに。

って、私もつい最近までは思っていましたのですが、

✓馬鹿でもできて

✓テクニカルも糞もなくて

✓相場観とかほぼ不要で

✓小難しいことが一切ないのに

✓7~8割くらいの勝率を叩き出せちゃう

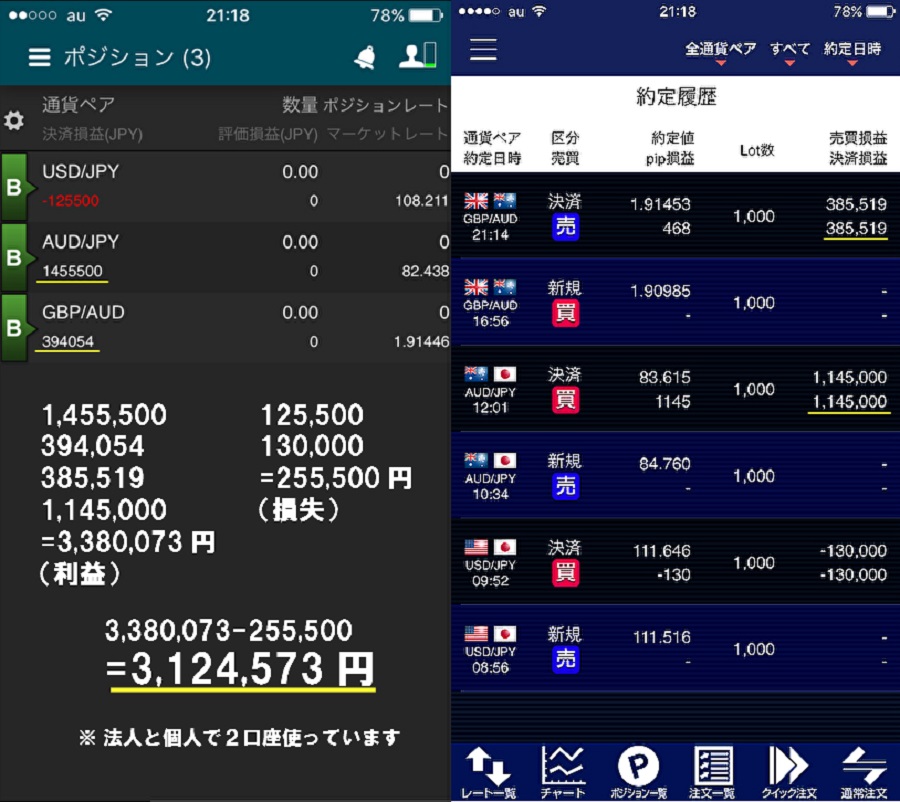

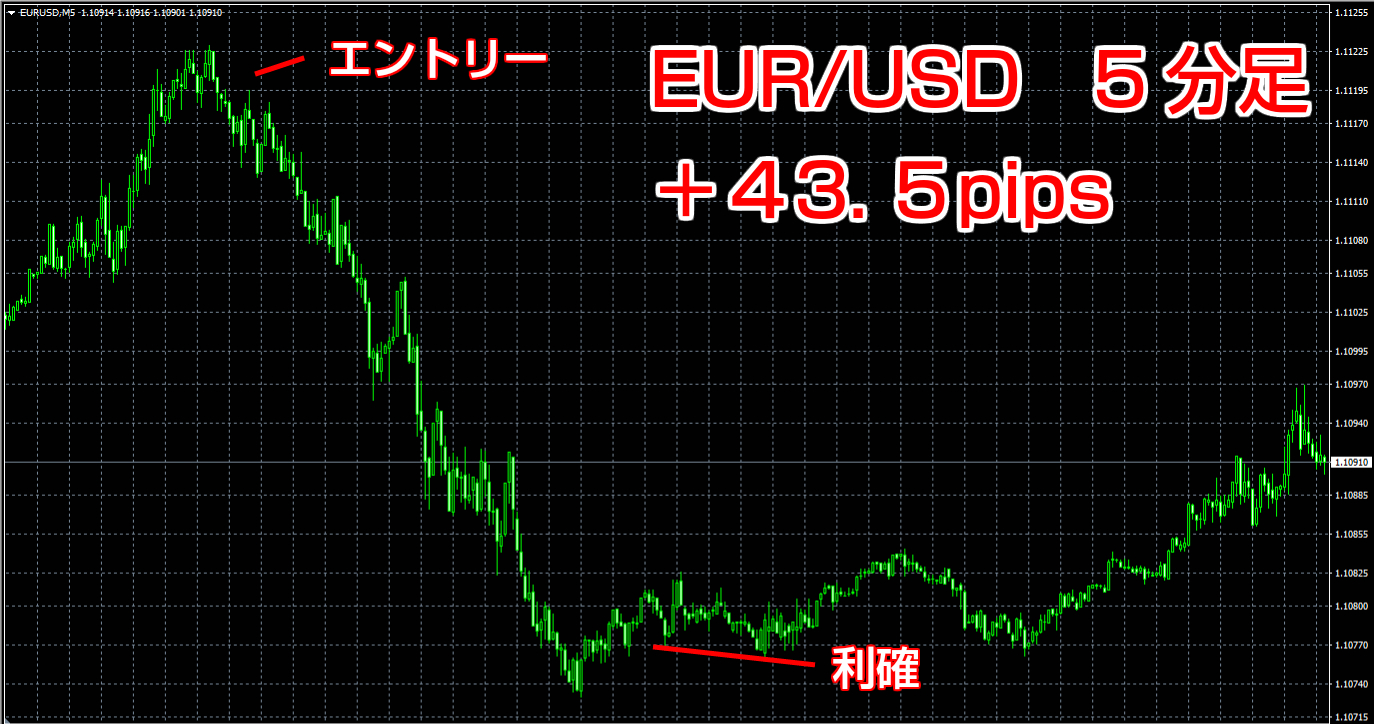

そんな手法を編み出してしまいました!